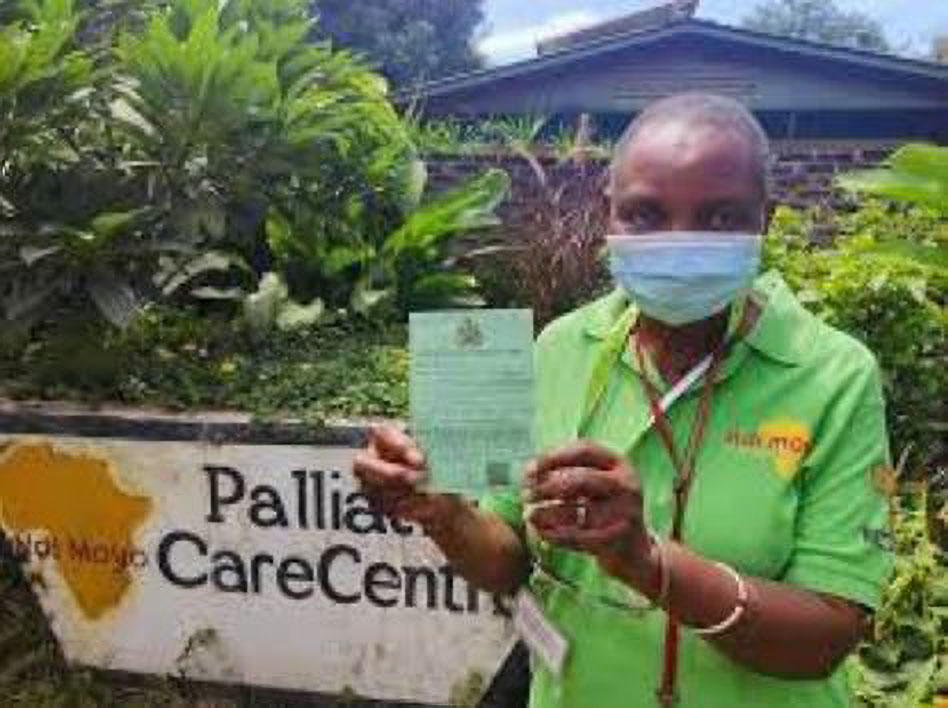

Ndi Moyo is the place giving life in Salima, Malawi and it is entirely funded by donations.

Leaving a Gift in your Will for Ndi Moyo UK is one of the best ways to ensure Ndi Moyo will be able to continue its excellent palliative care work for the benefit of future generations.

It doesn’t need to be a large amount, even a small donation can make a big difference!

In leaving a legacy for Ndi Moyo UK you might support the following costs at Ndi Moyo Palliative Care Malawi:

- £12,000 would pay for all medicines and equipment for a year or would run the ambulances for a year

- £5,000 is the salary for a nurse for a year

- £3,000 would run the Vulnerable Children’s Program for a year

- £850 would run the program for cervical screening for a year

- £40 would buy a blood pressure reading machine

- £18 pays for one session of adult chemotherapy

UNSURE HOW TO INCLUDE A GIFT TO A CHARITY IN YOUR WILL?

It’s pretty simple!

Firstly, thank you for making this wonderful decision. Many vital causes wouldn’t exist today without donations left in Wills.

Your legacy will help to ensure the continuity of the work of

Ndi Moyo Malawi.

Step One

You’ll need the charity’s name, address, and the registered charity number.

The details for Ndi Moyo UK are as follows:

Ndi Moyo UK

53 Uplands Rd London N8 9NH

UK Registered Charity Number: 1111045

Step Two

Find a solicitor or Will writer to write or update your Will.

Step Three

Provide your solicitor or Will writer with the details of your chosen charity, or charities.

CHOOSING THE TYPE OF GIFT TO LEAVE

Leaving a gift in your will can make a huge difference to the care of the dying in Malawi for future generations.

The most common types of legacy gifts left in wills are:

- Residuary Gift: The residue (or a proportion of the residue) of an estate after all other gifts, debts and expenses have been paid.

- Pecuniary Gift: This is a specific amount of money. This type of gift will, over time, devalue with inflation. If you wish to future proof your legacy, you can ask your solicitor about index linking your gift so it’s value keeps pace with inflation

- Specific Gift: A particular asset for example an investment or property

The wording for a residuary legacy can be as follows:

I give …% of the residue of my estate to Ndi Moyo UK Reg Charity No 1111045 of 52 Uplands Rd, London N8 9NH for its charitable purposes. I further direct that the receipt by the Honorary Treasurer or other proper officer of Ndi Moyo UK for the time being shall be a full and final sufficient discharge for the said legacy.

The wording for a pecuniary or specific legacy can be as follows:

I give to Ndi Moyo UK Reg Charity No 1111045 of 52 Uplands Rd, London N8 9NH the sum of £…../specific asset for its charitable purposes. I further direct that the receipt by the Honorary Treasurer or other proper officer of Ndi Moyo UK for the time being shall be a full and final sufficient discharge for the said legacy